Choosing the right type of bank account can make a significant difference in how you manage and grow your money, but with so many different types of bank accounts available, it can be difficult to know which one is best for your everyday transactions.

In this article, we will discuss the different types of bank accounts that are available, as well as the advantages and disadvantages of each.

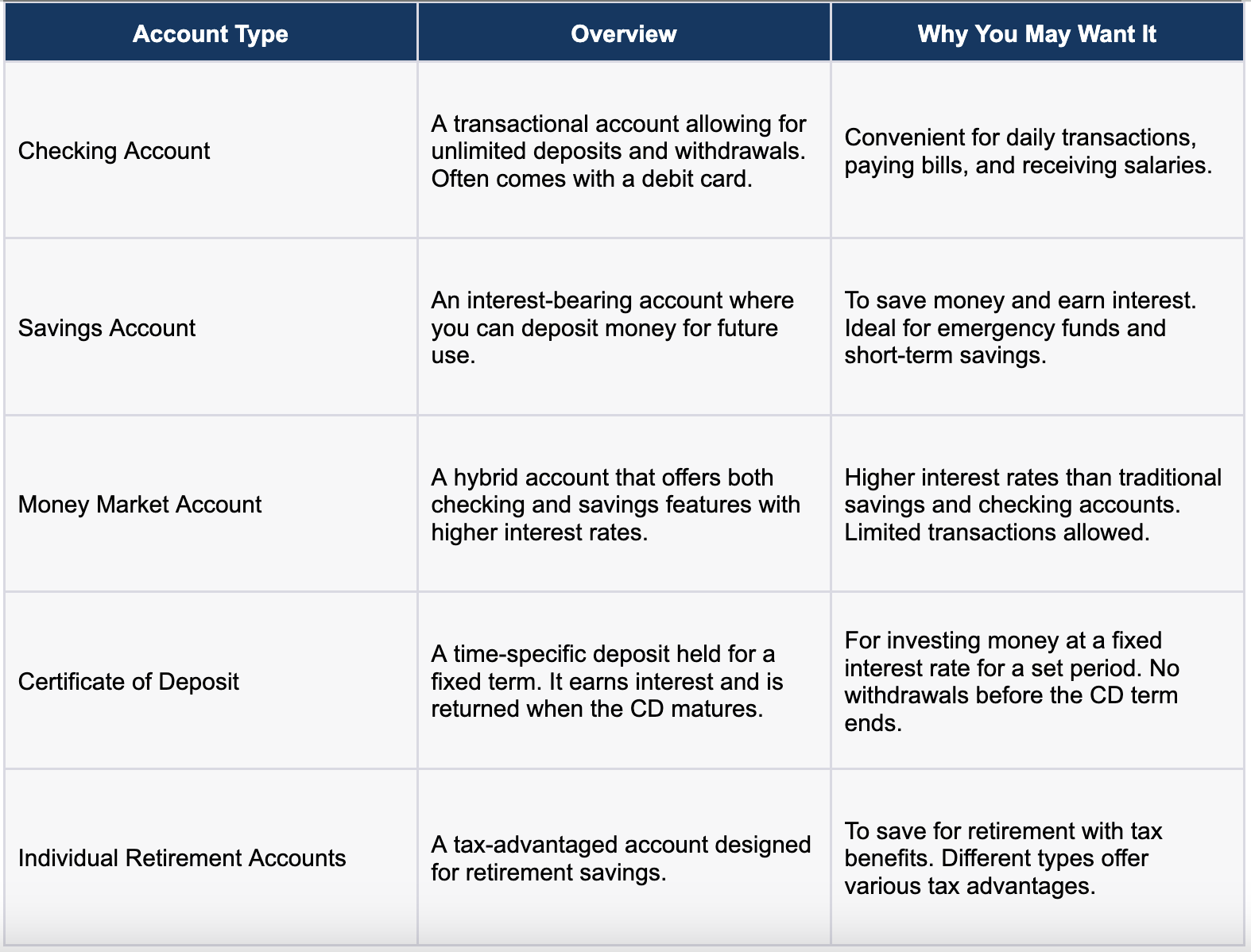

Specifically, we will cover the following types of bank account types:

- Checking Account

- Savings Account

- Money Market Account

- Certificate of Deposit

- Individual Retirement Accounts

By the end of this article, you will have a better understanding of the different types of bank accounts available and how to choose the right one for your needs.

Personal Checking Accounts

A personal checking account is a type of bank account primarily used for everyday transactions. Financial institutions offer these accounts to customers, allowing them to deposit and withdraw money, write checks, pay bills, and manage their finances. Most checking accounts come with a debit card, making it easy to access funds for purchases or withdrawing money from ATMs.

Benefits of a Personal Checking Account

- Easy access to funds with a debit card.

- Ability to write checks for payments.

- Online and mobile banking features for easy account management.

Potential Negatives of a Personal Checking Account

- May come with monthly maintenance fees.

- Overdraft fees can be high.

- Interest rates are typically lower than other account types.

Personal Savings Account

A personal savings account is a common type of bank account where individuals can store their money and earn interest over time. These accounts are ideal for setting aside emergency funds or saving for future expenses. They offer a safe place to keep money while also allowing it to grow through the interest rate provided by the financial institution.

Benefits of a Personal Savings Account

- Earn interest on the account balance.

- Encourages saving habits.

- Can be linked to checking accounts for overdraft protection.

- Digital tools for tracking savings goals.

Potential Negatives of a Personal Savings Account

- Limited number of withdrawals per month.

- May have minimum balance requirements.

- Lower interest rates compared to other investment options.

Money Market Accounts

Money market accounts are a type of savings account that typically offers higher interest rates than traditional savings accounts. They combine features of both checking and savings accounts, allowing for limited check-writing abilities and debit card access. These accounts are ideal for those looking for a higher yield while maintaining some liquidity.

Benefits of a Money Market Account

- Higher interest rates than traditional savings accounts.

- Access to funds with a debit card.

Potential Negatives of a Money Market Account

- May have higher minimum balance requirements.

- Limited number of transactions allowed per month.

- Monthly maintenance fees may apply.

CDs (Certificates Of Deposit)

Certificates of Deposit (CDs) are time-bound deposits that individuals make with financial institutions. The money is locked in for a specific CD term, and in return, the account earns a fixed interest rate. Once the CD matures, the initial deposit, along with the accrued interest, is returned to the depositor.

Benefits of a CDs

- Guaranteed return on investment.

- Higher interest rates than traditional savings accounts.

- Variety of CD terms to choose from.

Potential Negatives of a CDs

- Money is locked in until the CD matures.

- Early withdrawal penalties may apply.

- Interest rates may be lower than other investment options.

Individual Retirement Accounts (IRAs)

An Individual Retirement Account (IRA) is a tax-advantaged account designed to help individuals save for retirement. There are different types of IRAs, each with its tax benefits, contribution limits, and withdrawal rules. They are an essential tool for long-term retirement planning.

Benefits of an Individual Retirement Account

- Tax advantages on contributions and earnings.

- Diverse investment options.

- Helps secure financial future post-retirement.

Potential Negatives of an Individual Retirement Account

- Penalties for early withdrawals.

- Annual contribution limits.

- Mandatory withdrawals at a certain age.

Which Type of Bank Account is Best for Everyday Transactions?

For everyday transactions, a personal checking account is the most suitable. It offers easy access to funds, the ability to write checks, and typically comes with a debit card for purchases and ATM withdrawals.

Finding the Right Type of Personal Bank Account for You

Choosing the right bank account depends on your financial needs and goals. Whether you're looking for an account for daily transactions, saving for the future, or investing for retirement, there's an account type suited for you. Consider factors like interest rates, fees, accessibility, and features when making your decision. Bank accounts are essential tools in managing and growing your finances. By understanding the different types of accounts available, you can make informed decisions that align with your financial goals. Whether you're just starting out or looking to diversify your financial portfolio, there's a bank account tailored to meet your needs.