Buying a house is a major investment — think of all the money you could make down the line if you sell! This long-run potential isn’t your home’s only value, though. You can also use home equity lines of credit (HELOCs) and home equity loans to make the most of your home’s value today.

Both these types of loans turn the difference between your home’s value and what you’ve paid on it into cash you can easily access. This is great for covering major expenses, though you could risk foreclosure if you can’t repay what you borrow. Knowing which of the two options better fits your needs can help you minimize this risk and others as you pursue the funding you need. We’ll walk you through the home equity loan vs. line of credit debate below.

What is a home equity loan?

A home equity loan is a loan with regular monthly payments. The size of the loan is based on your equity in your home. Your equity is the difference between the market value of your home and the amount of principal you still owe on your mortgage. Home equity loan amounts are typically at most 80% of your equity.

If you get approved for a home equity loan, you’ll get a fixed interest rate, meaning your interest rate never changes over your loan’s lifetime. This lifetime is typically five, 10, or 15 years, and the steady interest rate makes for predictable monthly payment amounts. In any case, you’ll receive the full loan amount as one lump-sum deposit. Your home will also be your collateral for the loan, which follows naturally — the loan is, after all, based on your home’s value.

Maybe you’re noticing that home equity loans work pretty similar to fixed-rate mortgages. Well, that’s correct! In fact, when you’ve heard people say they’re taking out a second mortgage, that usually means they’ve taken out a home equity loan. This ties right into how most people use these loans: to cover large purchases. Home renovations, debt consolidation, university education, covering emergency payments — it’s all on the table with your home equity loan funds.

You might be eligible for a home equity loan if your equity is at least 15% to 20% of your home’s value. From there, you’ll need to prove that you have a steady income — this reassures lenders that you’re a low-risk borrower. You’ll also have better luck if your credit score is in at least the mid-600s and your debt-to-income (DTI) ratio is at most 35%.

Understanding a line of credit

A home equity line of credit (HELOC) is a revolving loan with a maximum borrowing limit equal to at most 85% of your equity. Since it’s a revolving loan, you can borrow up to the maximum amount at any time during your 10-year draw period. After this period comes your 20-year repayment period, during which you can only repay, not borrow from, your HELOC.

You can repay your borrowed amount at any time during your draw period to replenish your balance. This makes HELOCs a potentially bottomless well of funding for covering major expenses. The cost of borrowing this money, though, can change over time since HELOCs have variable interest rates. Their rates change as the U.S. Prime Rate changes.

In terms of how you can qualify for and use the proceeds of HELOCs, there’s really no difference between them and home equity loans. The same eligibility criteria and use cases apply to both — it’s just these loans’ structure that differs. Additionally, your home is your collateral for both, and all interest you pay on either type of loan may be fully tax-deductible. Namely, it’s tax-deductible if you use the money you borrow on your home rather than for other expenses.

Key differences between home equity loans and lines of credit

Here’s more info on how home equity loans and HELOCs aren’t quite the same.

- Their interest rates. Your home equity loan interest rate is fixed — it won’t change over time. That’s great if you get a loan when rates are low and not so great when rates are high. Conversely, HELOC interest rates are variable, so they may prove more favorable in the long run if you obtain them when rates are high. That said, fixed-rate HELOCs exist — they’re just not common. There’s no such thing, though, as a variable-rate home equity loan.

- How the funds are disbursed. You get one lump sum with a home equity loan, and you can immediately use the entire amount. You never have to use all of it, but the whole thing goes into your bank account no matter what. HELOCs, on the other hand, are for you to access as you please. Need $20,000 but your credit limit is $50,000? Take just that $20,000 — you’ll pay interest only on that, not the full $50,000.

- How you repay your loan. Although both home equity loans and HELOCs require monthly payments, HELOC payments vary tremendously. In months when you haven’t borrowed from your HELOC, you might owe no money at all. Your payment amounts depend entirely on how much you choose to borrow and the current interest rate. With home equity loans, the fixed interest rate and lump-sum deposit result in predictable monthly payments with no flexibility.

- The potential risks. Foreclosure is a risk with both loans — after all, your home is your collateral — but only HELOCs offer potentially unlimited money. This may seem like a dream come true, but it can also lead to overspending if you’re not careful. If you borrow more money than you can ultimately repay, then come your repayment period, you could quickly enter foreclosure.

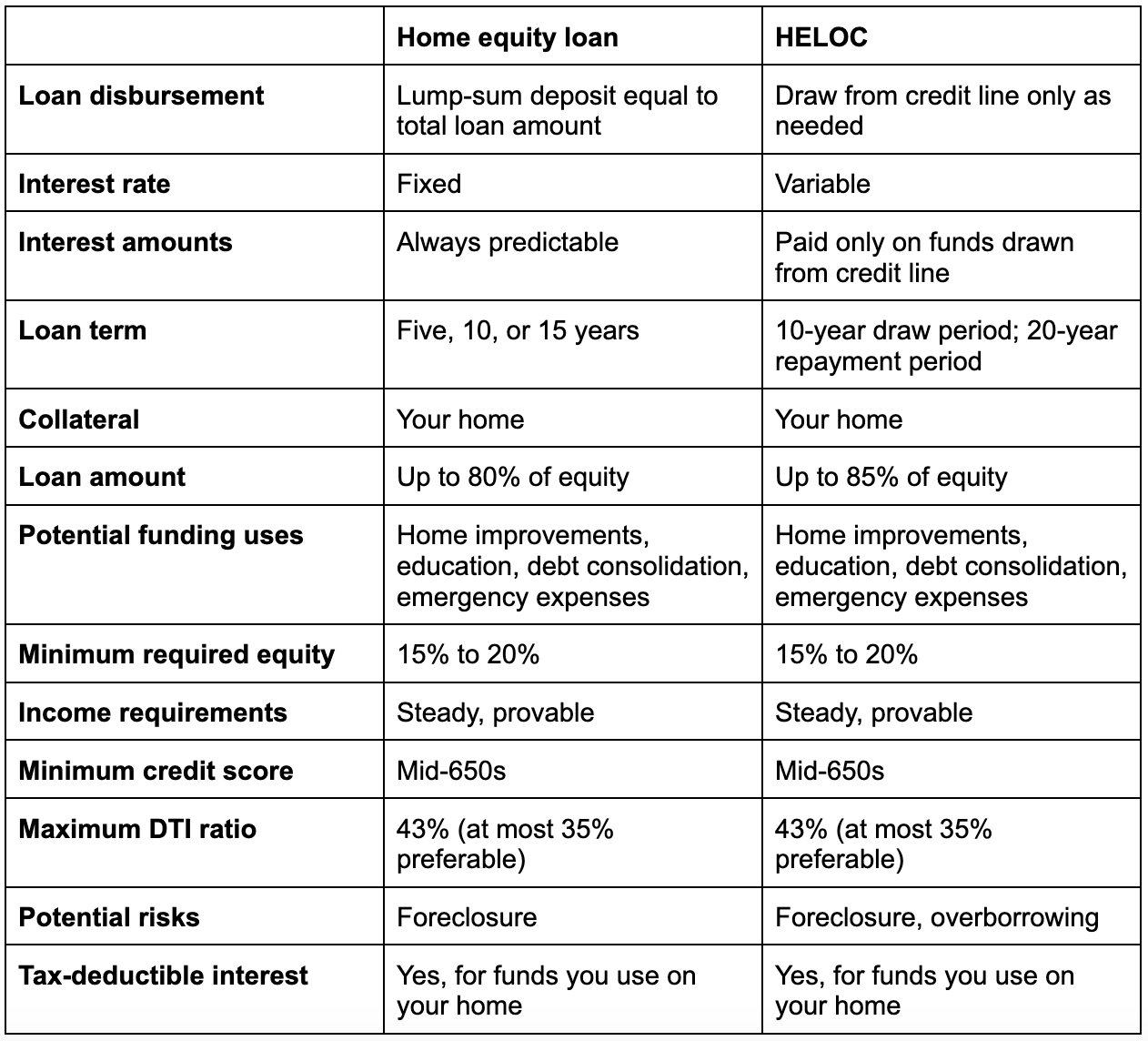

Summing it all up: a home equity loan vs. line of credit chart

Here are all the major HELOC and home equity loan similarities and differences in a neat chart. This will make it all especially easy to understand!

Choosing the right options for your needs

There’s no one right choice when it comes to home equity loans versus lines of credit — it depends on why you need the money. For example, if you know exactly the amount of money you need for exactly one expense, a home equity loan may be better. You get only that amount of money if approved, with predictable interest payments. If, on the other hand, you have long-term plans to renovate your home quite often, a HELOC could be better. Their borrowing flexibility means you can get money whenever it’s time to start a new renovation project. However, if a variable interest rate would prove troubling for your repayment ability, home equity loans might be better for you. The same might be true if you’ve previously struggled to not overspend on your credit cards (HELOCs are basically giant credit cards).

Still unsure which funding option might be right for you? There are experts who can help.

Leverage your home equity with UBank

Here at UBank, we’re all about helping people — and we mean that. Bring your questions about home equity loans and HELOCs to us, and we’ll help you make the decision that works for you. Our goal is to get you what you need and make you happy — you come first, not us. Visit the UBank branch nearest you to get the ball rolling on converting your home equity into a wellspring of cash.